Mastering the Feasibility Study Checklist in Dynamic London: A Guide for Office Relocation Specialists

Embarking on any business endeavor in the bustling and dynamic city of London requires careful planning and meticulous assessment. One essential tool in the arsenal of savvy entrepreneurs and project managers is the feasibility study checklist. In this urban hub where opportunities abound but competition is fierce, having a comprehensive checklist tailored to the unique London landscape can be the difference between success and uncertainty. Join us as we delve into the intricacies of this indispensable tool, unraveling the key components that make up a thorough feasibility study checklist fit for the vibrant business arena of London.

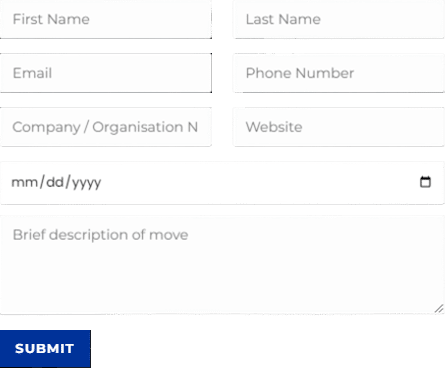

Discuss Your Move Today

Give us a call at 0208 575 1133, or use the form below to book your service.

This page supports our content about office relocation specialists and you can find other in-depth information about What is the feasibility study checklist in London by following this link or answers to related questions like What are the two key elements of a feasibility study in London if you click here.

For office relocation specialists in London, understanding the nuances of a feasibility study checklist is paramount. Now, let’s address some frequently asked questions (FAQs) about this essential tool.

What are the six basic components of feasibility study in London?

The six fundamental components of a feasibility study in London, particularly relevant for office relocation specialists, encompass:

These components collectively provide a comprehensive view of the feasibility of an office relocation project in London.

Market Analysis: Evaluating the local market’s demand, competition, and potential revenue in pounds.

Financial Projections: Estimating costs, revenues, and return on investment (ROI) for the relocation project in pounds.

Operational Assessment: Analyzing how the proposed relocation aligns with the company’s operations and processes.

Regulatory Compliance: Ensuring adherence to local regulations and obtaining necessary permits, involving costs in pounds.

Location Suitability: Assessing the chosen site’s accessibility, infrastructure, and suitability for the business.

Risk Analysis: Identifying and mitigating potential risks and uncertainties, quantifying their impact in pounds.

What are the 3 parts of feasibility study in London?

The three key parts of a feasibility study in London, particularly relevant for business transfer consultants, include:

These components collectively provide a holistic view of whether a business transfer project is feasible within the dynamic London market.

Market Feasibility: Evaluating the market demand, competition, and potential revenue in pounds for the proposed project.

Financial Feasibility: Assessing the project’s financial viability, encompassing cost estimations, revenue projections, and return on investment in pounds.

Operational Feasibility: Analyzing whether the project aligns with the company’s operations, workforce, and processes while considering pounds-based costs.

What are the 5 steps in performing a feasibility study in London?

Performing a feasibility study in London, especially for corporate removals professionals, involves five essential steps:

These steps collectively form a comprehensive framework for assessing the feasibility of corporate removal projects in London’s dynamic business environment.

Scope Definition: Clearly define the objectives and parameters of the study, specifying costs and potential benefits in pounds.

Market Research: Conduct thorough market analysis to understand demand, competition, and revenue potential in pounds.

Financial Assessment: Estimate project costs, revenue projections, and ROI, all in pounds, to evaluate financial feasibility.

Operational Evaluation: Analyze how the proposed project aligns with operational processes, considering pounds-based expenses.

Risk Analysis: Identify and mitigate potential risks and uncertainties, quantifying their impact in pounds.

Who conducts a feasibility study in London?

Feasibility studies in London are typically conducted by office relocation specialists or consultancy firms specializing in business relocations. These professionals assess the practicality and financial viability of office moves, offering insights in pounds to guide informed decisions within the dynamic London business landscape.

What is the difference between due diligence and a feasibility study in London?

The key difference between due diligence and a feasibility study in London, from the perspective of business transfer consultants, lies in their focus and scope.

Due diligence is a comprehensive examination of all aspects of a business, including its financials, operations, contracts, and legal obligations, to assess its overall health and potential risks. It aims to uncover any hidden issues or liabilities that could impact a business deal. The costs for due diligence can vary significantly depending on the complexity and scale of the business.

On the other hand, a feasibility study concentrates specifically on evaluating the viability of a proposed project or business venture within London’s market. It assesses factors like market demand, financial projections, operational aspects, and regulatory compliance, often with a focus on costs and potential revenues in pounds. The primary goal is to determine whether the project is feasible and financially viable in the London market.

In summary, while due diligence is a broader examination of an existing business, a feasibility study is a targeted analysis of a potential project’s viability in the context of London’s business environment, often emphasizing financial aspects in pounds.

What is the difference between a business plan and a feasibility study in London?

The distinction between a business plan and a feasibility study in London, especially for office relocation specialists, lies in their purpose and content.

A feasibility study primarily focuses on evaluating the viability of a specific project or business venture. It assesses factors like market demand, financial projections, operational aspects, and regulatory compliance, often emphasizing costs and potential revenues in pounds. The primary goal is to determine whether the proposed project is feasible and financially viable within London’s business landscape.

On the other hand, a business plan is a comprehensive document that outlines the entire strategy for a business. It includes details about the company’s mission, vision, goals, marketing strategies, operational plans, and financial projections. While a feasibility study informs the decision of whether to proceed with a project, a business plan provides a roadmap for how the business will operate and achieve its objectives in London, often with a focus on financial aspects in pounds.

In essence, a feasibility study is a precursor to a business plan, helping to assess whether a project is worth pursuing, while a business plan outlines the broader strategy for the entire business in the London market.

How do you write a simple feasibility study in London?

Writing a simple feasibility study in London, as understood by business transfer consultants, involves the following steps:

By following these steps, you can create a simple yet informative feasibility study tailored to the dynamic business environment of London.

Define the Scope: Clearly outline the objectives and parameters of the study, specifying costs and potential benefits in pounds.

Market Analysis: Research the local market, considering factors such as demand, competition, and revenue potential in pounds.

Financial Assessment: Estimate project costs, revenue projections, and return on investment (ROI), all in pounds, to assess financial feasibility.

Operational Evaluation: Analyze how the proposed project aligns with operational processes, considering pounds-based expenses.

Risk Analysis: Identify potential risks and uncertainties, quantifying their impact in pounds and outlining mitigation strategies.

Conclusion: Summarize findings and offer a clear recommendation based on the assessment’s outcomes in pounds.

How do you organize a feasibility study in London?

Organizing a feasibility study in London, particularly for office relocation specialists, involves a structured approach:

This structured approach ensures that the feasibility study is organized, comprehensive, and tailored to the unique demands of the London business landscape.

Define Objectives: Clearly state the study’s goals, specifying costs and potential gains in pounds.

Gather Data: Collect data on market demand, competition, costs, and regulatory requirements in London, ensuring pounds-based analysis.

Financial Assessment: Estimate project costs, revenue projections, and ROI, all in pounds, to evaluate financial viability.

Operational Analysis: Analyze how the project aligns with operational processes, considering pounds-based expenses.

Risk Evaluation: Identify potential risks and uncertainties, quantifying their impact in pounds and proposing mitigation strategies.

Report and Recommendations: Present findings coherently, offering a clear recommendation based on the assessment’s outcomes in pounds.

What is a feasibility study example in London?

An example of a feasibility study in London for workplace moving experts could involve assessing the viability of relocating an office to a specific area of the city. This study would include:

This example demonstrates how a feasibility study in London can help workplace moving experts make informed decisions about a potential office relocation project within the city’s competitive business landscape.

Market Analysis: Researching the demand for office spaces in pounds, analyzing competitors, and identifying potential clients.

Financial Assessment: Estimating costs in pounds for office setup, relocation, and ongoing operations, along with revenue projections.

Operational Evaluation: Analyzing how the move aligns with existing operational processes and workforce capabilities, factoring in pounds-based expenses.

Location Suitability: Assessing the chosen area’s accessibility, infrastructure, and suitability for the business.

Regulatory Compliance: Ensuring adherence to local regulations and obtaining necessary permits, involving costs in pounds.

Risk Analysis: Identifying and mitigating potential risks, such as market fluctuations or logistical challenges, with quantified impacts in pounds.

What are feasibility study skills in London?

Feasibility study skills in London, valued by corporate removals professionals, include:

These skills empower professionals to navigate London’s dynamic business landscape and make informed decisions regarding corporate removal projects.

Financial Analysis: Proficiency in evaluating costs, revenue projections, and return on investment in pounds.

Market Research: Ability to assess market demand, competition, and potential earnings in pounds.

Operational Expertise: Understanding how proposed projects align with operational processes and pounds-based expenses.

Regulatory Knowledge: Familiarity with local regulations and compliance requirements, involving costs in pounds.

Risk Assessment: Skill in identifying and mitigating potential risks and uncertainties, quantifying impacts in pounds.

In conclusion, grasping the significance of the feasibility study checklist in London is the cornerstone for effective decision-making, particularly for office relocation specialists navigating this dynamic cityscape. This tool serves as a compass, guiding professionals through the labyrinth of opportunities and challenges that London presents. With the knowledge of What is feasibility study checklist in London? at your disposal, you’re equipped to make well-informed choices, ensuring the success of your business endeavors in this vibrant and competitive urban landscape.

Ready to navigate London’s business landscape with confidence using the feasibility study checklist? Contact Universal Commercial Relocation at 0208 575 1133, and let us guide your success.