Deciphering Relocation Benefits: What Can You Claim in London?

Embarking on a relocation journey to the vibrant and bustling city of London often entails a myriad of expenses. As you prepare to make your move to this iconic metropolis, one burning question arises: what exactly can you claim for relocation expenses in this dynamic financial hub? Navigating the intricacies of relocation allowances and expenses can be a daunting task, but fear not, for we’re about to embark on a journey to uncover the answers. Join us as we delve into the details of what you can claim when relocating to London, shedding light on a topic of significant importance for many individuals and businesses planning their move to this diverse and thriving city.

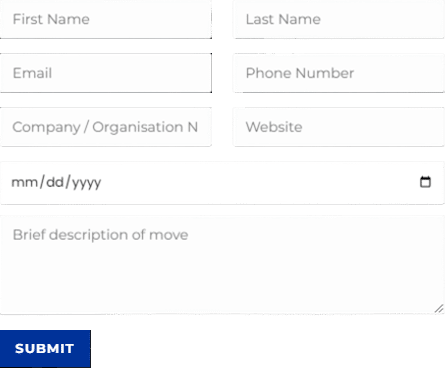

Discuss Your Move Today

Give us a call at 0208 575 1133, or use the form below to book your service.

This page supports our content about office relocation costs and you can find other in-depth information about How does a relocation package work in London by following this link or answers to related questions like Do I pay tax on relocation allowance in London if you click here.

Before we dive into the specifics of office relocation costs and what can be claimed in London, let’s address some frequently asked questions that will help demystify this intricate financial landscape.

What are qualifying costs for relocation expenses in London?

Qualifying costs for office relocation expenses in London typically include expenses related to the relocation of employees. This may encompass expenses such as transportation, accommodation, temporary storage of belongings, and reasonable travel and subsistence costs. It’s essential to consult with a tax professional or refer to HM Revenue and Customs (HMRC) guidelines for specific details and eligibility criteria, as rules may vary.

Can I ask for a relocation allowance in London?

Yes, you can request a relocation allowance in London when moving your business. The allowance may cover various costs associated with the relocation, such as moving expenses, lease termination fees, and temporary accommodation costs. However, the availability and terms of such allowances may vary, so it’s advisable to discuss this with your employer or consult with relevant HR and financial departments for specific details and eligibility criteria.

How much can claim for home office expenses in London?

The amount you can claim for home office expenses in London varies depending on your circumstances and tax regulations. Generally, you can claim allowable expenses related to working from home, such as utility bills and office equipment costs. To determine the specific amount you can claim, refer to HM Revenue and Customs (HMRC) guidelines or consult with a tax professional for accurate advice tailored to your situation.

In conclusion, understanding what you can claim for relocation expenses in London is paramount for anyone planning a move to this vibrant city. As we’ve explored the intricacies of relocation allowances and expenses, it becomes evident that clarity in this regard is essential for sound financial planning. To make informed decisions and ensure you maximize your benefits, consider seeking advice from professionals well-versed in UK tax regulations. So, as you embark on your journey to London, remember that knowledge is the key to unlocking the full potential of your relocation, ensuring a smooth transition and financial peace of mind.

Ready to optimize your relocation in London? Contact Universal Commercial Relocation at 0208 575 1133 for expert guidance on maximizing your claimable expenses. Your smooth move starts here.