Demystifying Taxation: Do I Pay Tax on Relocation Allowance in London?

When embarking on a journey that involves relocating to the vibrant and bustling city of London, there’s a myriad of factors to consider. One of the pivotal questions that often arises is whether the relocation allowance you receive is subject to taxation. In the labyrinthine world of taxation, especially in a sprawling metropolis like London, understanding the ins and outs of your financial responsibilities is crucial. So, let’s dive into the depths of this inquiry to unravel the complexities surrounding the taxation of relocation allowances in London, shedding light on a topic of great significance to many individuals and families planning their move to this iconic city.

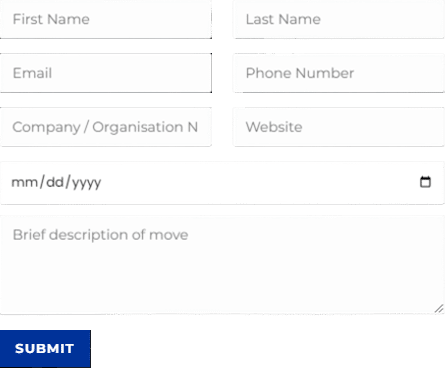

Discuss Your Move Today

Give us a call at 0208 575 1133, or use the form below to book your service.

This page supports our content about business transfer fees and you can find other in-depth information about What can you claim for relocation expenses in London by following this link or answers to related questions like Are relocation costs taxable in London if you click here.

Before we delve into the specifics of business transfer fees and their tax implications in London, let’s address some frequently asked questions that can provide valuable insights into this intricate financial matter.

In conclusion, the tax treatment of relocation allowances in London holds substantial importance for those venturing into the city’s dynamic environment. Having explored the intricacies of this subject and addressed common queries, it becomes clear that understanding your tax obligations is essential to financial planning when relocating to this iconic metropolis. To make informed decisions and ensure compliance, it’s advisable to seek professional advice from experts well-versed in UK tax regulations. So, if you’ve been wondering, Do I pay tax on relocation allowance in London? remember that with the right knowledge and expert support, you can embark on your London journey with confidence and financial clarity.

Seeking clarity on tax matters related to your relocation in London? Contact Universal Commercial Relocation at 0208 575 1133 today for expert guidance and peace of mind. Your financial journey starts here.