Unlocking Financial Advantages: Can You Claim VAT on Relocation Expenses in London?

In the fast-paced world of corporate relocations, every penny saved counts. So, you might be wondering: Can you claim VAT on relocation expenses in London? Understanding the ins and outs of Value Added Tax (VAT) in the context of moving to this vibrant city is not only financially prudent but also crucial for ensuring a smooth transition. London, with its diverse business landscape and unique tax regulations, presents a unique scenario for those embarking on a new chapter in their professional lives. Whether you’re a business owner planning an office move or an employee making a career shift, let’s unravel the complexities of VAT claims on relocation expenses and pave the way for cost-effective success.

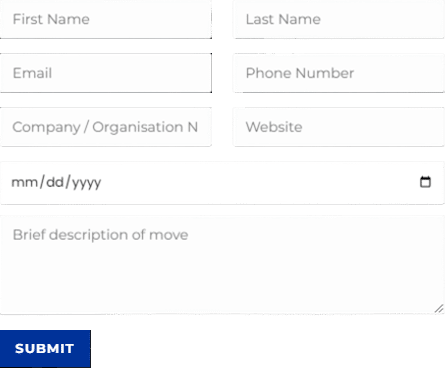

Discuss Your Move Today

Give us a call at 0208 575 1133, or use the form below to book your service.

This page supports our content about business transfer fees and you can find other in-depth information about Can a director claim a relocation allowance in London by following this link or answers to related questions like How does a relocation package work in London if you click here.

Before we delve into the frequently asked questions about business transfer fees, let’s explore the essential aspects of claiming VAT on relocation expenses in London.

What expenses are VAT exempt in London?

In London, certain expenses related to moving a business are VAT exempt. These typically include the sale of a business as a going concern, the transfer of assets as part of a business merger or acquisition, and certain property transactions. However, it’s essential to consult with a tax professional to ensure compliance with current VAT regulations and eligibility for exemptions.

What expenses are VAT claimable in London?

In London, VAT can typically be claimed on office relocation costs, including services provided by VAT-registered suppliers such as removal companies, legal fees, and professional services directly related to the move. However, specific eligibility and documentation requirements apply, so it’s advisable to consult with a tax expert for precise guidance.

Can you claim VAT on staff leaving gifts in London?

In London, VAT on staff leaving gifts is generally not claimable as a business expense. Such gifts are considered non-business-related expenditures and are subject to standard VAT regulations.

Can relocation allowance be used for rent in London?

Yes, relocation allowances can often be used for rent in London. This financial support is typically provided to help employees cover various costs associated with a business transfer, including accommodation expenses such as rent. However, specific terms and conditions may vary depending on the employer’s policy, so it’s essential to consult with your company’s HR department for detailed guidance.

How much is VAT on removals in London?

The VAT rate on removal services in London is currently 20%. This rate is subject to change based on government regulations, so it’s advisable to verify the current rate before your office relocation to ensure accurate cost calculations.

In conclusion, as you navigate the intricacies of corporate relocations in London, understanding the possibility of claiming VAT on relocation expenses is indeed a financial advantage. It can significantly impact your bottom line, making your move to this vibrant city more cost-effective. So, whether you’re an employer planning a business transfer or an employee embarking on a career change, seize the opportunity to maximise your financial benefits. Should you have any more queries about VAT claims or other relocation-related matters in London, feel free to reach out. Your journey to a successful relocation in the heart of the UK capital begins with knowledge and smart financial decisions. Can you claim VAT on relocation expenses in London? The answer is yes, and with the right guidance, you can make the most of this opportunity.

Ready to optimize your relocation expenses in London? Contact Universal Commercial Relocation today at 0208 575 1133, and let us help you navigate the VAT claim process for maximum savings.