Director Relocation Allowances in London: Navigating the Essentials

In the fast-paced corporate landscape of London, where talent often crosses boroughs and counties, the question arises: Can a director claim a relocation allowance in the capital? As the epicenter of business and innovation, London’s magnetic pull often prompts executives to traverse its diverse neighborhoods, seeking new opportunities and fresh beginnings. Whether you’re a seasoned director contemplating a strategic move or a business owner exploring options for key personnel, understanding the dynamics of relocation allowances in this dynamic city is essential. So, let’s embark on a journey to decipher the intricacies of director relocation allowances, ensuring that talent acquisition and retention in London remain seamless and rewarding.

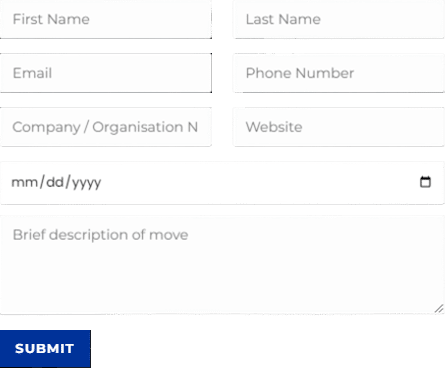

Discuss Your Move Today

Give us a call at 0208 575 1133, or use the form below to book your service.

This page supports our content about corporate removal expenditures and you can find other in-depth information about Are office relocation costs tax deductible in London by following this link or answers to related questions like Can a director claim a relocation allowance in London if you click here.

Before we delve into the frequently asked questions about corporate removal expenditures, let’s explore the critical considerations surrounding director relocation allowances in London.

What are non-qualifying relocation expenses for HMRC in London?

Non-qualifying relocation expenses for HMRC in London include personal expenses, such as meals, entertainment, and expenses unrelated to the office relocation. These are not eligible for tax relief. It’s essential to maintain clear records and adhere to HMRC guidelines for eligible expenses.

In conclusion, the ability for a director to claim a relocation allowance in London can be a pivotal factor in attracting and retaining top talent in this bustling metropolis. As we’ve navigated the intricacies of this topic, we hope you now have a clearer understanding of the opportunities and considerations involved. Whether you’re an executive contemplating a move or a business owner looking to support key personnel, making informed decisions about director relocation allowances can be a game-changer. If you have further questions or require personalized guidance, don’t hesitate to seek professional advice. Can a director claim a relocation allowance in London? Yes, and by leveraging this benefit effectively, you can ensure that your journey towards success in the corporate world remains both seamless and rewarding in the heart of London.

Ready to explore director relocation allowances in London? Contact Universal Commercial Relocation today at 0208 575 1133 for expert guidance on optimizing talent acquisition and retention.