Tax Deductibility of Office Relocation Costs in London: Key Insights

The prospect of relocating your office in London can be an exciting venture, but it often comes with a host of financial considerations. Among these, a critical question emerges: Are office relocation costs tax deductible in London? Understanding the intricacies of tax deductions in the context of office relocation is essential for prudent financial planning. In this comprehensive guide, we’ll delve into the nuances of tax deductions related to office relocations in London, shedding light on how your business can potentially benefit from these deductions while navigating the dynamic landscape of the UK capital. So, let’s unravel the complexities surrounding tax deductions and office relocation costs in London!

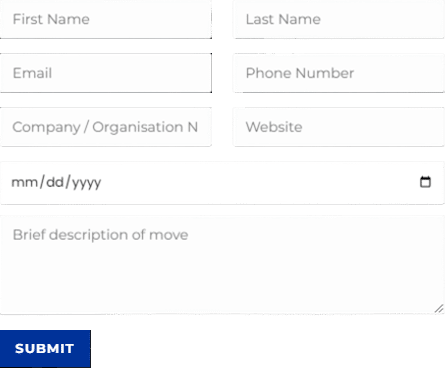

Discuss Your Move Today

Give us a call at 0208 575 1133, or use the form below to book your service.

This page supports our content about office relocation costs and you can find other in-depth information about Are relocation costs taxable in London by following this link or answers to related questions like Can a director claim a relocation allowance in London if you click here.

As we embark on this exploration of tax deductions and their implications on office relocation costs in London, let’s now address some frequently asked questions (FAQs) that will provide you with a comprehensive understanding of the tax landscape and financial considerations associated with your office move.

Are relocation costs taxable in London?

Relocation costs incurred when moving a business in London are typically not taxable. However, it’s essential to consult with tax professionals and stay updated on current tax regulations, as specific circumstances and expenses may vary. Generally, businesses can explore potential tax deductions rather than facing direct taxation on relocation costs.

Do I pay tax on relocation allowance in London?

In London, the tax treatment of a relocation allowance can vary depending on the specific circumstances and the nature of the allowance. Typically, relocation allowances are considered taxable income. However, some relocation expenses may qualify for tax relief or exemptions. It’s advisable to consult with tax professionals or HM Revenue and Customs (HMRC) for guidance on the taxation of your specific relocation allowance to ensure compliance with current tax regulations.

What can you claim for relocation expenses in London?

When relocating in London, you can potentially claim certain expenses as part of your relocation package. Common claims may include:

It’s crucial to work closely with your employer or HR department to understand the specific relocation expenses that can be claimed, as company policies and packages may vary. Additionally, keep detailed records and receipts to support your claims for tax purposes.

Transportation Costs: Expenses related to moving your belongings and family, such as removal and transportation fees, as well as travel expenses to your new location.

Temporary Accommodation: Costs for temporary housing or accommodation while you search for a permanent residence in London.

Storage Expenses: Fees for storing your belongings during the transition period.

Legal and Professional Fees: Charges for legal services, permits, and consulting fees associated with the relocation.

Travel Expenses: Reimbursement for travel costs incurred during the move, such as meals, lodging, and transportation.

Housing Costs: Rental or lease costs for your new residence or office space in London.

Utility Connection Fees: Expenses for connecting utilities like electricity, water, gas, and internet services at your new location.

School Fees: If applicable, reimbursement of school-related expenses for children.

How does a relocation package work in London?

A relocation package in London typically involves financial support and assistance offered by an employer to facilitate an employee’s move. It may include:

The specific details and monetary value of a relocation package can vary depending on the company’s policies and the employee’s role. It’s essential to discuss the package with your employer to understand the benefits and conditions associated with your relocation to London.

Transportation: Coverage of moving expenses, such as hiring a removal company or renting a vehicle.

Accommodation: Temporary housing or assistance in finding a new home in London.

Travel Costs: Reimbursement for travel expenses related to the relocation, including flights, meals, and lodging.

Storage Fees: Coverage of fees for storing belongings during the move.

Legal and Administrative Support: Assistance with legal paperwork, permits, and visas.

Utility Connection: Support for connecting essential utilities at the new residence.

Schooling: If applicable, aid in finding suitable schools for children.

Can you claim VAT on relocation expenses in London?

Yes, in London, you can often claim VAT (Value Added Tax) on eligible relocation expenses related to your business move. However, the ability to claim VAT may depend on various factors, including the type of expenses and your VAT registration status. It’s advisable to consult with tax professionals or HM Revenue and Customs (HMRC) to determine which relocation expenses are eligible for VAT recovery and ensure compliance with VAT regulations.

Can a director claim a relocation allowance in London?

Yes, a director in London can potentially claim a relocation allowance as part of their corporate removal expenditures. However, the eligibility and specific terms of the allowance may vary depending on the company’s policies and contractual agreements. It’s advisable for directors to discuss relocation packages and allowances with their employers or HR departments to understand the benefits and conditions applicable to their specific situation.

In conclusion, the question of whether office relocation costs are tax deductible in London is a critical one for businesses looking to manage their finances effectively. By delving into the complexities of tax regulations and exploring potential deductions, you can make informed decisions that positively impact your bottom line. If you have further queries or need personalized guidance regarding Are office relocation costs tax deductible in London?, don’t hesitate to consult with tax professionals who can provide tailored insights to ensure your office move in this dynamic city is as financially efficient as possible. Wishing you a successful and cost-effective office relocation in London!

Ready to navigate the complexities of tax deductions for office relocation costs in London? Contact Universal Commercial Relocation today at 0208 575 1133, and let us guide you toward financial efficiency in your business move!