Demystifying Storage Expenses: Navigating Business Costs in London

In the bustling metropolis of London, where the heartbeat of commerce resonates through its historic streets, entrepreneurs and business owners often find themselves navigating the labyrinth of tax regulations. One burning question that frequently arises amidst the city’s dynamic business landscape is, Can I claim storage as a business expense in London? It’s a query that can have a substantial impact on the bottom line of enterprises, both large and small, as they seek to optimize their financial strategies within the confines of Her Majesty’s Revenue and Customs (HMRC) guidelines. In this quest for financial efficiency, understanding the rules surrounding storage expenses becomes paramount, and we’re here to shed light on the matter. So, if you’re a business operator in London looking to unravel the mysteries of storage expenses, you’ve come to the right place. Let’s embark on this journey through the tax intricacies of the UK capital.

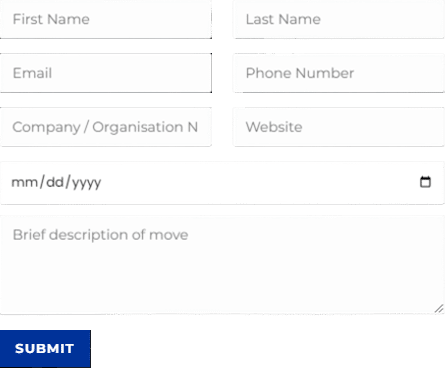

Discuss Your Move Today

Give us a call at 0208 575 1133, or use the form below to book your service.

This page supports our content about industrial reserve letting and you can find other in-depth information about Are tenants allowed to use loft in London by following this link or answers to related questions like How big is 10×10 storage unit in London if you click here.

Before we delve into the frequently asked questions about claiming storage as a business expense in London, let’s address another crucial aspect of the matter—industrial reserve letting.

What can landlords offset against tax in London?

Landlords in London, including those engaged in industrial reserve letting, can offset various expenses against tax. These may include mortgage interest, property maintenance costs, insurance premiums, property management fees, and even certain finance charges. However, tax regulations can change, so it’s essential to consult with a tax professional or HMRC for the most up-to-date information regarding allowable deductions and tax benefits, ensuring compliance with UK tax laws while maximizing financial efficiency.

How much of my rent can I claim as a business expense in London?

When it comes to industrial reserve letting in London, the amount of your rent that you can claim as a business expense varies depending on several factors. Typically, you can claim the full amount of your rent as a business expense if the property is used exclusively for business purposes. However, if it’s a mixed-use property, where part is used for business and part for residential purposes, you can only claim the portion that relates to your business use. It’s crucial to maintain accurate records and consult with a tax advisor to determine the allowable deduction and ensure compliance with UK tax regulations.

How does the 20% tax credit work for landlords in London?

The 20% tax credit for landlords in London, including those involved in industrial reserve letting, relates to the tax relief on mortgage interest. Instead of deducting mortgage interest as an expense, landlords can claim a 20% tax credit on the interest paid. This change, implemented in April 2017, is being phased in over several years. It means that landlords can no longer deduct all their mortgage interest when calculating their taxable profit. Instead, they receive a tax credit worth 20% of their mortgage interest payments. It’s essential for landlords to understand this credit’s implications and consult with a tax advisor to ensure compliance with current tax regulations while optimizing their financial strategies.

What are the penalties for not declaring rental income in London?

Failure to declare rental income in London, whether it’s from commercial storage rental or other sources, can lead to penalties imposed by HMRC. The penalties can vary depending on the severity of the non-compliance. Typically, the penalties may include:

It’s crucial to ensure accurate and timely reporting of rental income to avoid these penalties and remain in compliance with UK tax laws. If you have concerns about past non-compliance, it’s advisable to contact HMRC or a tax advisor to rectify the situation and minimize potential penalties.

Late Filing Penalties: If you fail to report your rental income by the deadline, you can face late filing penalties, which can range from £100 to £1,600 or more, depending on the delay.

Inaccuracy Penalties: If HMRC discovers inaccuracies in your tax returns, you may be subject to penalties based on the underpaid tax amount, which can be as high as 100% of the tax owed.

Interest Charges: In addition to penalties, you may also be charged interest on any unpaid tax from the due date.

Can you reclaim VAT on rental property expenses in London?

In London, as in the rest of the UK, the ability to reclaim VAT on rental property expenses depends on whether you are a VAT-registered business. If you are a VAT-registered business and the expenses are incurred for business purposes, you may be able to reclaim the VAT paid on eligible expenses related to commercial storage rental. However, it’s essential to keep detailed records and ensure that the expenses meet HMRC’s criteria for VAT reclamation. If you are not VAT-registered or if the expenses are for non-business purposes, you generally cannot reclaim the VAT. Consulting with a tax advisor or HMRC for specific guidance based on your circumstances is advisable to ensure compliance with VAT regulations.

Is office storage tax deductible in London?

Office storage expenses in London, including those associated with industrial reserve letting, can be tax-deductible if they are incurred for the purpose of your business. These expenses may include the cost of renting storage space, insurance, and maintenance fees related to the storage facility. To ensure tax deductibility, it’s crucial to maintain proper records and demonstrate that the expenses are directly related to your business operations. Always consult with a tax advisor or HMRC for specific guidance tailored to your individual circumstances to ensure compliance with UK tax regulations.

Is rent for office space a selling expense in London?

In London, as in the UK, rent for office space, including expenses related to commercial storage rental, is typically considered an operating expense rather than a selling expense. Operating expenses cover the day-to-day costs of running a business, while selling expenses are specifically related to the sale of goods or services, such as marketing and advertising costs. Rent for office space falls under the category of operating expenses, which are necessary for business operations but not directly tied to the act of selling products or services. However, it’s essential to consult with a financial advisor or accountant to categorize expenses correctly for your specific business and tax situation.

Can you claim mortgage against rental income in London?

In London, you can typically claim a portion of your mortgage interest as an allowable expense against rental income when engaged in business inventory hiring. However, it’s essential to note that since April 2017, the rules for claiming mortgage interest relief have changed. Landlords can no longer deduct all their mortgage interest when calculating taxable profit. Instead, a tax credit is available, currently at 20% of the mortgage interest payments. To ensure accurate tax reporting and compliance with UK tax laws, it’s advisable to consult with a tax professional or HMRC for the most up-to-date information and guidance tailored to your specific circumstances.

Why the sums no longer add up for small-time landlords in London?

The sums no longer add up as seamlessly for small-time landlords in London due to changes in tax regulations, particularly the reduction in mortgage interest relief. Before April 2017, landlords could deduct the full amount of mortgage interest from their rental income when calculating taxable profit. However, this has changed, and now landlords receive a 20% tax credit on their mortgage interest payments. Additionally, factors such as increased operational costs, regulatory burdens, and market dynamics have made it more challenging for small-scale landlords to achieve the same level of profitability as in the past. These changes have prompted landlords to reevaluate their financial strategies and adapt to the evolving landscape of the rental property market in London.

Is rent an allowable expense self-employed in London?

Rent, including expenses related to enterprise depot occupancy, can be an allowable expense for self-employed individuals in London if it is incurred for the purpose of running the business. These expenses can include the cost of renting office or workspace, storage facilities, or any other premises essential for business operations. However, it’s crucial to keep accurate records and demonstrate that these expenses are directly related to your self-employed business activities. Consulting with a tax advisor or HMRC is advisable to ensure proper classification and compliance with UK tax regulations.

What expenses are allowed for capital gains tax in London?

When it comes to capital gains tax (CGT) in London, expenses related to business inventory hiring can be taken into account. However, it’s essential to consider these key points:

It’s essential to maintain accurate records of these expenses and consult with a tax advisor or HMRC for specific guidance on how to calculate and report capital gains tax while considering business inventory hiring expenses.

Acquisition Costs: You can include the cost of acquiring the business inventory in the base cost for CGT purposes. This includes the purchase price and any associated fees, such as legal and surveying fees.

Improvement Costs: Expenses incurred for improving or enhancing the inventory can also be considered when calculating CGT. These costs may include renovation expenses or other improvements that increase the inventory’s value.

Selling Costs: Expenses directly related to the sale of the inventory, such as marketing and advertising expenses, can be deducted to reduce your capital gain.

Professional Fees: Fees paid to tax advisors or professionals for CGT advice or assistance can also be included as allowable expenses.

In the intricate tapestry of London’s business landscape, financial strategies and tax regulations intertwine to shape the success of enterprises. We hope that the FAQs and insights provided have shed light on the complexities of claiming storage as a business expense in London, offering valuable guidance to entrepreneurs and business owners navigating the city’s thriving commerce scene. As you continue your journey through the labyrinth of tax regulations, remember that staying informed and seeking professional advice when needed are your strongest allies. With a firm understanding of the rules and nuances surrounding industrial reserve letting and business expenses, you can confidently steer your business towards financial efficiency and prosperity in this vibrant metropolis. Can I claim storage as a business expense in London? The answer lies in the careful consideration of HMRC guidelines, your specific business needs, and the knowledge gained on this insightful journey.

Ready to explore how Universal Commercial Relocation can help you optimize your business expenses in London? Contact us today at 0208 575 1133 and let’s start maximizing your financial strategies.