Unlocking London’s Investment Potential: Why Not to Invest in Self-Storage?

In the ever-evolving landscape of London’s real estate and investment opportunities, one question looms large for prospective investors: Why not to invest in self-storage in this vibrant metropolis? As the capital city bustles with activity and economic dynamism, it’s essential to critically examine all investment avenues. While self-storage facilities have gained popularity as a lucrative investment option, there are compelling reasons to consider alternative avenues in this competitive marketplace. Join us as we delve into the key factors that may give you pause before plunging into the self-storage investment realm in London.

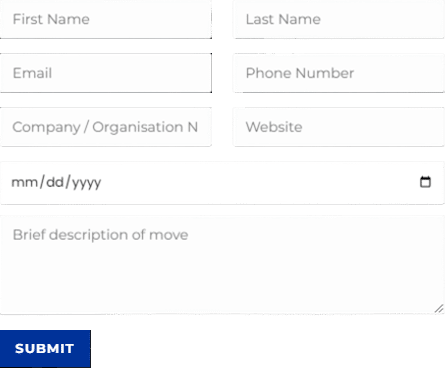

Discuss Your Move Today

Give us a call at 0208 575 1133, or use the form below to book your service.

This page supports our content about commercial storage near me and you can find other in-depth information about What is the best storage facility in London by following this link or answers to related questions like Can you work in a storage unit in London if you click here.

Before we dive into the FAQs addressing why not to invest in self-storage in London, let’s address another common query: What are the advantages of commercial storage near me? This will provide context for those seeking alternative investment avenues and storage solutions in the city.

What are the disadvantages of self-storage in London?

The disadvantages of self-storage in London can include:

Considering these drawbacks, exploring alternative investment options such as commercial storage near you may provide a more balanced risk-reward ratio and better long-term prospects.

Costs: Self-storage fees can accumulate, impacting your overall investment or budget.

Limited ROI: Self-storage may offer lower returns compared to other real estate investments.

Competition: London has a competitive self-storage market, making it challenging for new investors.

Maintenance: Managing and maintaining storage facilities can be time-consuming and costly.

Market Saturation: Some areas may be oversaturated with self-storage facilities, affecting occupancy rates.

What are the disadvantages of self-storage units in London?

The disadvantages of self-storage units in London can encompass:

Given these drawbacks, exploring alternative investment avenues, such as commercial storage near you, may offer a more balanced risk-reward ratio and better long-term prospects in pounds.

Costs: Self-storage fees can accumulate, impacting your budget.

Lower ROI: Self-storage may yield lower returns compared to other real estate investments.

Competition: London’s competitive market poses challenges for new investors.

Maintenance: Managing and maintaining storage facilities can be costly and time-consuming.

Saturation: Some areas may have an oversupply of self-storage, affecting occupancy rates.

Does self-storage do well in a recession in London?

Self-storage can be relatively recession-resistant in London due to its ability to offer cost-effective storage solutions during economic downturns. In uncertain times, individuals and businesses often seek to downsize or temporarily store possessions, creating a steady demand for storage facilities. However, the performance can vary based on location and market saturation. Exploring alternative investment options like commercial storage near you remains a prudent strategy for diversification and stability in pounds.

Is public storage a good long term investment in London?

The long-term investment prospects of public storage in London can be influenced by factors such as location, market conditions, and investment goals. While it can offer stable returns, it’s essential to conduct thorough due diligence. Exploring alternatives like commercial storage near you may provide diversified investment opportunities, potentially aligning better with your objectives in pounds.

As our exploration comes to a close, the question Why not to invest in self-storage in London? leads us to a wealth of insights. While self-storage may offer tempting prospects, London’s investment landscape is multifaceted and evolving. The factors we’ve uncovered shed light on why alternative avenues may better align with your investment goals and strategies. In a city renowned for its economic dynamism, choosing the right investment path is an art, one that requires careful consideration of all available options. Whether you’re exploring commercial storage solutions or other investment opportunities, London’s diverse offerings await those with a discerning eye for value and growth.

Ready to explore alternative investment opportunities in London? Contact Universal Commercial Relocation today at 0208 575 1133 and make informed decisions for your future.